Finding a solution in between large-scale market transformation and full traceability

A SPOC Impact Story, November 2022

In the palm oil sector, one of the main global systems for supply chain certification has become the center point of discussion. On one side of the debate, the proponents of the so-called Mass Balance (MB) models argue that:

“Identity Preserved and Segregated supply chains are preferable where possible and could be perfect. However, Mass Balance offers an opportunity to work on inclusive transformation in production and consumption markets. Let’s not make perfect the enemy of good!” Ashwin Selvaraj (RSPO)

The opponents in the debate say that:

“The new law must not allow operators to use mass-balance systems as provided by certification schemes: these systems fail to ensure that commodities and products placed on the EU market are not linked to deforestation or forest degradation and do not require the complete traceability and transparency of supply chains.” Together 4 Forests civil society campaign.

The multistakeholder initiative RSPO sees the MB models as the most affordable way to scale up the production and demand of certified material. However, critics point out that the lack of traceability in the MB models allows for non-sustainable palm oil to enter the European Union’s market suggesting it is sustainable, which would be some form of greenwashing. This story provides insights into what the MB model actually entails and has achieved so far. On top of that, we suggest a solution that balances between large-scale market transformation and full traceability.

What is the Mass-Balance model?

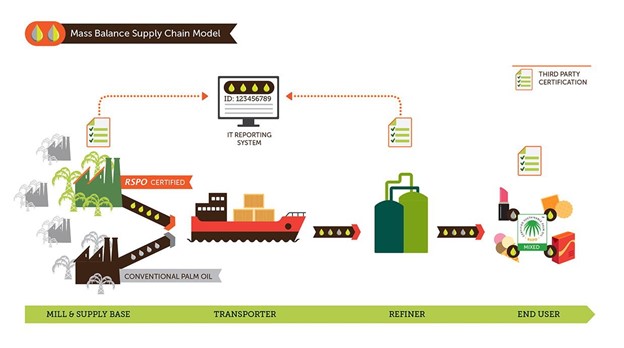

The first thing that should be clarified is that although the MB model is often spoken of as a single model, it actually consists of two models of mixing material along the supply chain where the purchase of certified volumes matches the sale of certified volume. The two models are:

- Mixing after the Palm Oil mill (downstream) – this is the most well-known model. Most of the time 100% certified IP or SG material is mixed with conventional material in the ship, tanks or factory. The mixing is allowed through the supply chain to reduce costs for logistics and distribution.

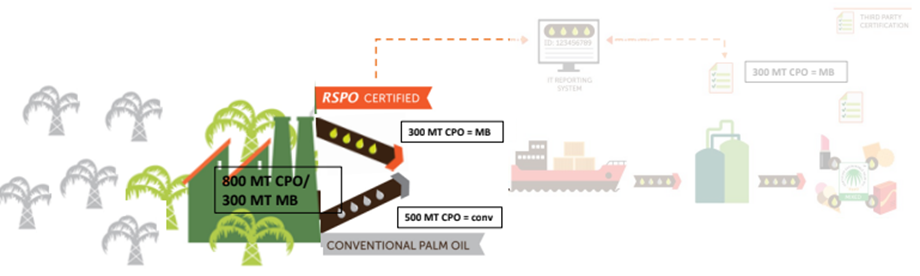

- Mixing at the mill (Fresh Fruit Bunches are mixed at the mill) – the other MB model allows the mill to mix certified and non-certified Fresh Fruit Bunches (FFB). This model is most used to allow a mill that has its own plantations certified to also take in non-certified Fresh Fruit Bunches that is produced by surrounding smallholders that are not certified. The auditor that checks the Mill for certification administers a maximum certified volume to the mill based upon its own certified plantations. The MB CPO leaving the mill can never exceed that original amount.

Mass Balance model where FFB is mixed at mill-level.

The RSPO Identity Preserved (IP) and the Segregated (SG) supply chain models do not allow for mixing certified with non-certified palm oil.

- Identity Preserved: Sustainable palm oil from a single identifiable certified source is kept separately from ordinary palm oil throughout the supply chain.

- Segregated: Sustainable palm oil from different certified sources is kept separate from ordinary palm oil throughout the supply chain.

Buying a certain volume of MB certified palm oil guarantees that the same volume was produced at the beginning of the supply chain. This ensures that farmers are enabled to produce sustainably and can receive an RSPO-premium in return. However, the certified oil, which originated at the farmer, does not directly end up with the end-user that paid for the premium. The allowance of mixing along the supply chain results in lower logistical costs as MB oil doesn’t need to be kept separated. Therefore, in general MB carries a lower premium than SG.

Uptake of sustainable palm oil via the MB model

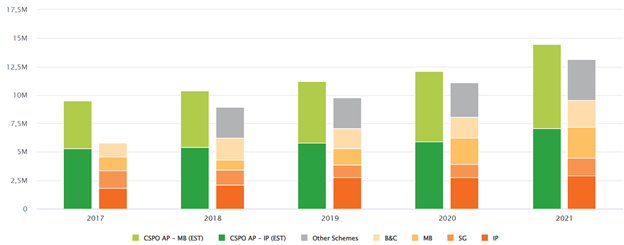

To describe the value of the MB model, it is necessary to present some production and import data. In the past years, around 50% of the certified sustainable palm oil volumes are produced in accordance with the Mass Balance model (where mixing takes place before MIll level)

Source: RSPO webpage (September 2022), rspo.org/impact

In a September 2022 overview of European CSPO uptake, consultancy NewForesight explains that: “While the European markets favor segregated/ identity-preserved CSPO, worldwide consumption of physical CSPO is relatively equally distributed across mass balance (MB), SG, and IP along with continued usage of RSPO Credits. In newer markets in Asia, Africa, and Latin America, RSPO Credits and MB are a first step towards sustainability, especially in markets where the distribution and logistics of physical CSPO is not yet fully developed.” [1]

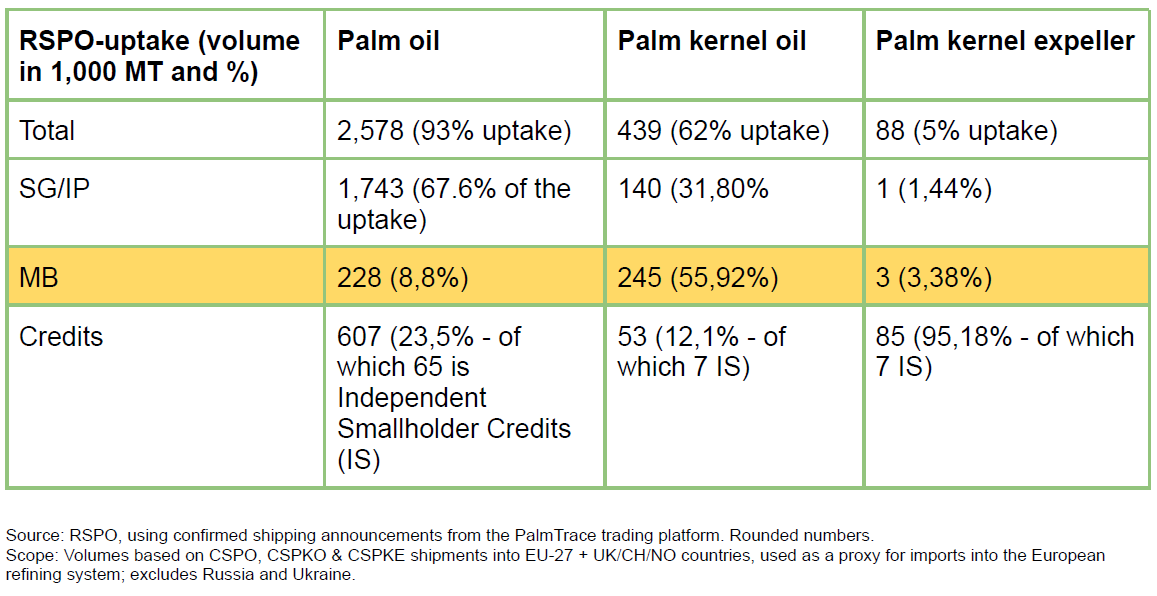

The exact distribution by trade model shows that for European food, feed and oleochemicals consumption the MB model is mainly used for palm kernel oil [2]. This table shows the distribution of RSPO certified uptake in 2021:

What is the value of the Mass Balance model?

Having a clearer view of the uptake of Certified Sustainable Palm Oil via the MB model, we can now look at why the model is considered to be so valuable by supply chain actors. In the words of the RSPO:

- “MB is a model that allows for transformation at scale by allowing the millers and the rest of the supply chain to engage with conventional producers and supply chain actors. Engagement leads to transformation.

- Smallholders manage 40% of the land that is cultivated with oil palm. Transformation of the sector is not possible without inclusion of smallholders. Mass Balance offers a market mechanism to include smallholders in the sustainable supply chains and contribute to their livelihood improvement

- ‘In some sectors [or geographies] it can be hard to find SG or IP material due to either a lack of demand or the composition of co-products. However, MB products are largely available and can represent a good way to stimulate a sector”, says the RSPO. This especially applies to Palm Kernel Oil and Palm Kernel Expeller.

Smallholders

The MB model helps smallholder farmers to enter sustainable markets. Mills that are RSPO certified as MB are allowed to buy FFB volume that is not certified. At this stage few smallholders are certified. For smallholders it is often quite difficult to get RSPO-certified. The level of (legal) paperwork is high and often legal requirements like land titles are hard to obtain. Also ensuring verification of practices can be costly because of high auditing costs. While the RSPO is trying to improve this, after two decades of Certified Sustainable Palm Oil (CSPO), only 70,000 hectares or 1.5 percent of Roundtable on Sustainable Palm Oil (RSPO) certified land belongs to independent farmers who make their own management decisions.

At the moment, through the MB model uncertified smallholders can get access to a RSPO certified mill and the global market. The more than 1 million independent smallholders worldwide often have access to only one or in the best case a few mills. If these mills start to procure only RSPO certified FFB, non-certified smallholders can no longer sell their FFB. Social NGO Solidaridad argues that “smallholder engagement is [often] a lengthy process that requires investment, planning and long-term involvement of all stakeholders. While there are opportunities for smallholders to gain real benefits from sustainable oil palm production, the large number of heterogeneous farmers means that achieving this potential requires specific policy approaches and financial support structures.“

What about traceability in the Mass Balance model?

Despite these benefits, also the RSPO itself considers MB as an intermediary way to physical certification. That is why it is currently conducting a review process to strengthen the model: “With a final target of shifting the whole industry to sustainable palm oil and the physical certification as the most direct and efficient scheme to achieve control over the supply chain, RSPO aims to enhance the robustness of the MB model, both at the plantation and supply chain level, recognising its role as an intermediary way to drive overall industry uptake of CSPO.”

Traceability

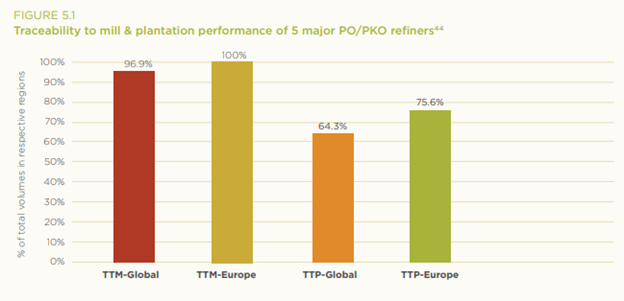

Because of the palm oil industry’s traceability initiatives, most of the MB certified sustainable palm oil that enters the European market can be traced back to the mill where it was first processed (Traceability To Mill – TTM). NewForesight shows that “Out of a sample of five major PO/PKO refiners that publish data on traceability, on average 100% of PO/ PKO that is imported into Europe is traceable to mill-level. 75.6% of PO/PKO imported into Europe is traceable back to plantations”.

EPOA, IDH, RSPO (2022), Sustainable Palm Oil: Europe’s Business Facts, analysis, and actions to leverage impact, p. 40.

Entry of non-sustainable palm oil into the market

With the EU regulation on deforestation demanding full traceability to plantation-level (Traceability To Plantation – TTP) and deforestation-free production, it becomes clear that palm oil products supplied through the MB model by itself do not meet these requirements.

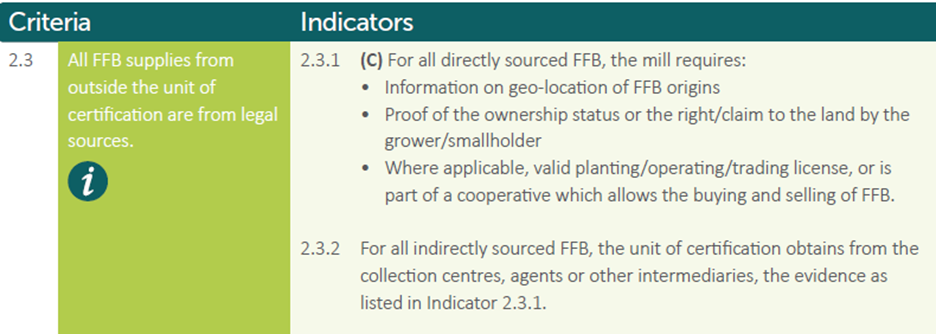

It is interesting to note that indicator 2.3.2 of the RSPO Principles & Criteria requires geo-location and proof of ownership of all directly sourced FFB. If this is well organised the palm oil certified against the MB model could comply with at least the geo-location and the legality requirement of the new EU Deforestation Regulation. In the past the RSPO allowed 4 countries (Malaysia, Sierra Leone, Nicaragua, Ecuador) to implement interim measures “where the unit of certification has smallholder suppliers, for existing RSPO certified mills”. However, for Malaysia, the period for interim measures ends on 15 November 2022.

It is also worth noting that palm oil buyers already often go beyond what is asked in the RSPO MB standard, by asking for No Deforestation, No Peat and No Exploitation (NDPE) commitments. With this ask they complement certification with additional information.

RSPO (2018), Principles and Criteria for the Production of Sustainable Palm, p. 19.

Conclusions and Recommendations

From the above it becomes clear that there is a value for the Mass Balance model to support market transformation. There is however an opportunity to make the MB model more future-proof. Regulations from producing and importing countries, as well as private sector initiatives are spurring the model to become more robust. As a transformative model, it is expected to be strict in excluding the non-sustainable producers and be lenient in including the sustainable producers.

As SPOC we see an opportunity here. We think the Mass Balance model could be strengthened by creating minimum criteria to which material that is brought in by MB certified producers needs to comply. If this can be tied to compliance with for example the MSPO, ISPO and APSCO standards, it could make the model more robust, while also stimulating the uptake of these standards. When this is implemented, the Mass Balance models can be a sector-wide collaborative effort that raises the floor for the laggards, while at the same time raising the bar for the best-performing tightrope walkers.

Footnotes:

[1] The researchers also note that among the CS Palm Oil, CS Palm Kernel Oil and CS Palm Kernel Expeller markets, CSPO is the most mature market. “As the largest consuming market for CSPO in the world, Europe plays an important role in allowing balanced development of the CSPO and CSPKO markets by ensuring an entrenched demand base for CSPO that allows CSPKO supply to grow in response to CSPO development in other regions, easing the global CSPKO supply tightness.” Although very relevant, this Impact Story does not dive any deeper in this highly technical discussion.

[2] Netherlands CSPO consumption by trade model. Source: DASPO (2021), Voortgangsrapportage over het gebruik van duurzame palmolie in Nederland – 2020.